When The Government Goes Down, The Stock Market Goes... Up?

As a country, we spent the first half of October being told it was reckoning day. On one side, we had Republicans saying the country is better off without a government than with Obamacare and, on the other, we had Democrats throwing out language like “gun to the country’s head,” and doing everything but proclaiming the end of civilization as we know it.

We spent over two weeks being urged to understand the severity of the damage the shutdown was doing to our economic well-being.

While government may be up and running again, it's too late. Once again, we’ve put our economy in peril, something backed up by the Dow Jones and S&P 500, two of the best indicators of economic strength, when we look at the before and after.

Stock market before shutdown:

Dow Jones – 15,117.40

S&P 500 – 1,684.77

Stock market after shutdown:

Dow Jones - 15,371.65 (up 1.74)

S&P 500 – 1733.15 (up 3.74%)

Wait, what? Wasn’t the whole point here that the government shutdown and the fear of exhausting our borrowing authority were terrible for the economy? This has to be an aberration, so let's look at the most recent shutdown before this apocalypse-inducing one instead.

Stock market before shutdown:

Dow Jones – 5,176.73

S&P 500 – 616.34

Stock market after shutdown:

Dow Jones – 5,181.43

S&P 500 – 616.71

I’m still not ready to accept the idea that my elected representatives could have lied to me and/or been wrong about the shutdown's disastrous economic effects so we’re going to go all the way back through the other 16 shutdowns since Carter took office and hope the numbers prove the last two were anomalies.

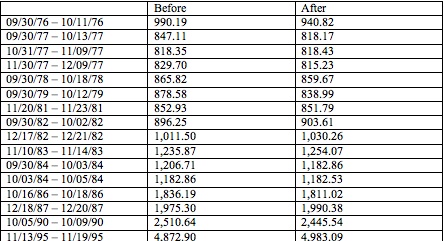

Before we dive into the numbers (and stick with me through the numbers), a note: in instances where the government shutdown started or ended on a day the stock market was not open I chose the closest active date preceding the close or following the re-opening. This is worth mentioning as it turns out a disproportionate number of government shutdowns occurred over a single weekend.

Now, lets look at the markets.

Now lets look at the table again, except this time the shutdowns in which the market ended higher than it started will be in bold.

So, if we include the two most recent government shutdowns, the Dow Jones has opened higher than it closed eight out of 18 times; while less than 50 percent, that’s a ratio that hardly screams “the sky is falling” to me.

This becomes even more true if we arbitrarily shorten the timeframe to after Jimmy Carter left office, in which case seven of 12 shutdowns have ended with the Dow Jones higher than when the government originally turned the lights off.

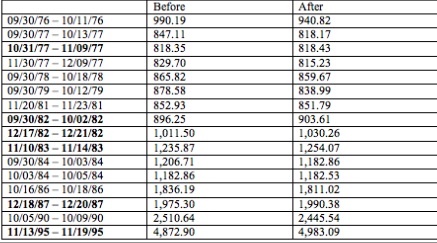

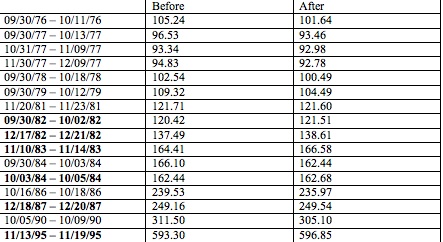

Next, lets look at the same time frames but measured on the S&P 500:

Same exercise: lets' look at the table again, with shutdowns where the market ended higher in bold.

Think about the post-Carter numbers. The Dow Jones has come out better for the shutdown nearly 60 percent of the time, while the S&P 500 has ended higher than it started a full 2/3 of the time. This is not to say that the shutdown didn’t hurt the people who got furloughed (ok, it didn’t: they get all of their back pay and got two weeks off), but to say that it's time we changed the rhetoric in these situations.

I’m tired of the President, the Senate and the House of Representatives treating us like we’re dumb. I’m tired of being told everything is the end of the world when it quite clearly isn’t. First, it was the sequester waiting to kill the economy (just FYI: both the Dow Jones and S&P are higher now than they were the day the sequester started), and then it was the shutdown. Next, it will be the deadline to pass a budget in January.

It isn’t a good thing to be without a working government and you’ll never hear me say otherwise. It isn’t healthy for our country to have leadership incapable of leading and government incapable of governing. However, it is time we stopped accepting being treated like children. We need to be done saying what we’re given is enough. As citizens, we have an obligation to demand truth, logic and something other than hyperbole. Next time our government shuts down, and it will, I want someone to tell me more than: “It’s going to kill the economy.”

We would all love to have a government that doesn’t get pushed to its brink every year, but I’m done believing that every time there’s turmoil or disruption or sequester, life ends. I find myself trying to figure out why the shutdown would hurt the stock market when it does just fine with a completely ineffective, yet open, government. I hope Congress can reach a budget deal before the upcoming January deadline. But when they don’t? I’m through believing the sky will fall and the stock market will crash when it has actually improved for over half of the shutdowns since Carter left office. We've seen time and time again that the positives of a government reopening are significantly greater than the negatives of that same government closing.

October 1 may be remembered as the day the government shut down.

But to me, it will be remembered as the day I shut down my own belief in the rhetoric spewing from anyone with a D.C. area code.