The Real Reason Behind Student Debt

“If you judge a fish by its ability to climb a tree, it will live its whole life believing that it is stupid.”

–Albert Einstein

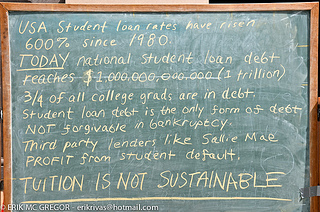

It is no secret that the United States is facing an increasingly large student debt crisis. Some simple math makes it easy to see why.

As we can see, the median income for an American household is not nearly what most people would guess. Dual-earner households, which account for 47 percent of all households in the country, do a little better, with an annual median income of about $20,000 more a year than their single-earner counterparts.

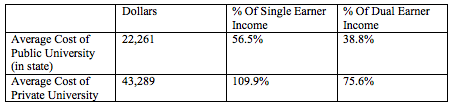

Now, lets see how much of that income a university is projected to absorb for each enrolled student:

Yes, you’re seeing that correctly. For the average single-earner family, sending a child to private university would cost 110 percent of the household income. Even the most financially feasible option, an average dual income household sending one child to public university, costs close to 40 percent of that family’s income after taxes. That means that even with a mortgage payment, car insurance, medical insurance and general living expenses to account for, we still expect families to be able to spend 40 percent of their income on university.

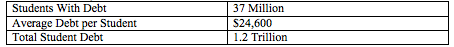

Unsurprisingly, student debt in the United States is out of control:

What is more, student loans are federally insured, meaning they are one of the few types of debt that are unforgiveable in bankruptcy court.

As a nation, we have put ourselves in the untenable position of either crippling our families or crippling our students, neither of which is a satisfactory option. We may be able to look at the $34,985 dollars left to a dual-income family sending their child to a public school and say that it's manageable, but is that really what we are aiming for? Isn’t the goal to put our families and students (of which I am one) in positions to thrive?

To this point, 23 of the top 26 schools in the country according to U.S. News are private institutions. As children, we are always told to go for the best, but the best is leaving many students with over $100,000 in debt.

So if the best schools cost $43,289 a year, and even the most financially manageable situation costs a family 40 percent of its annual income, what can we do to fix the problem?

My home state of Oregon has taken a model found in Australia and tweaked it to come up with a new way of paying for the education of its students. The proposed “Pay it Forward” plan would allow all Oregon residents who choose to attend a state school to graduate loan-free, as they would not have to pay any tuition for the duration of their time at school. Though the Pay it Forward bill passed in the state government calls simply for a pilot program to begin in 2015, its unanimous passing gives us every reason to believe it will soon become law.

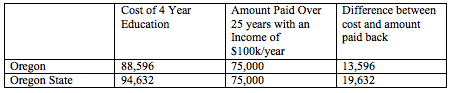

The plan calls for each student to pay 3 percent of his or her paycheck back to the state for the first 25 years of his or her career, regardless of income. This means that someone who makes $600,000 over those 25 years will only end up paying $18k for a four-year degree, while someone who makes $2.5 million will pay $75k.

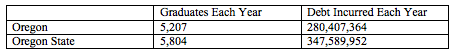

However, when we look at the estimated cost of attendance at the University of Oregon, we find that $75k doesn’t even cover the cost of a four-year degree. The same holds true for Oregon State.

Those are sobering numbers; unfortunately they become even more sobering when we multiply them out across the number of students graduating from these two schools every year. But wait, it gets worse. Those numbers are based on a student making an average of $100,000 a year for the first 25 years of his or her career. As of 2010, 93.4 percent of individuals in the United States were earning fewer than $100,000 a year, and I’ll bet a very small fraction of that remaining 6.6 percent are recent college graduates.

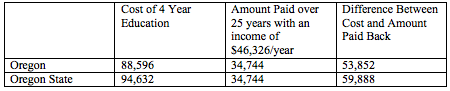

Actually, your average college graduate earns $44,259 after leaving school, just a shade away from the median household income, so let's just use that.

The state of Oregon is proposing to take on $50,000 of debt per student. If it seems like a lot, that's because it is.

Under the Pay It Forward plan, my home state is advocating the taxpayer take on an additional $627,997,316 every year. That means that from the time I stepped foot on campus at USC to the time that I graduate, my home state wants to increase its debt by $2,511,989,264.

There’s just no justification for that kind of reckless spending.

Take away the fact that my parents shouldn’t have to pay even more to someone else’s education before they can pay a penny to mine. Take away the fact that the 3 percent coming in from those salaries will never make it back to the taxpayers who funded the original investment. Take away the fact that the odds that 100 percent of students graduate in just four years is 0. Take away the possibility of average salaries failing to increase. Take away every other completely reasonable objection I could raise to this plan and just look at the debt Oregon wants to bring upon itself.

Maybe this is like a child learning from a parent; maybe Oregon lawmakers see their counterparts in Washington scoffing at the notion of balancing a budget and think they can do the same. My home state is already $5 billion in debt this fiscal year and owes over $37 billion total. At some point you have to pay the piper.

How is it that these politicians have never even seen a calculator? There are things that look great on pamphlets and posters, and then there are things that actually work; this is undoubtedly the former. Pay it Forward is a nice slogan when it applies to you buying the cute girl in line behind you at Starbucks her fifteen word drink order, not when it is just your home state passing the buck.

If I can do this simple math for the purposes of an op-ed, how in the world can our elected officials not be expected to do the same before passing major legislation? Imagine if legislation like this were passed in every state across the nation, covering all twenty million university students. That’s $56k (average) not paid back five million times over, a calculation that works out to $275,000,000,000 in nationwide debt every year.

Our first option for paying for education was crippling student debt; our second is crippling national debt. While today’s news media would have us believe it is acceptable to simply pose problems without offering solutions, that type of thinking isn’t satisfactory. There has to be a way to fix an educational system that is doing more financial harm than good.

My Granny Joan spent her life as a teacher. She has repeatedly said that her and her colleagues were in agreement that a nation could not afford to send more than 35 percent of its population to four-year schools. That isn’t a number that will sit well with most people. We grow up being told we can do anything; all our lives, our parents say we can be whatever we want to be and do whatever we want to do.

The harsh reality of life is that our parents lied to us, every single one of them. We can’t all do anything. We can all do about four things and those four things are different for all of us, some of them taught at university, some not.

The amount of debt in this country is so high because we have had an agenda pushed on us that everyone has to go to university. We have been told over and over again, whether directly or not, that we are lesser people if we don’t have a bachelor’s degree. I attended a public high school and even that public school had a habit of minimizing the options laid out for us that don’t involve educations that cost $62k a year (USC’s estimated 2013-14 cost of attendance; I wish I were kidding).

Instead of pushing people to do what they are actually best at, regardless of what education it requires, we diminish the contributions of any job we can’t describe as one done by an “academic.” There are tens of millions of people in the United States whose talents lie in fields not encompassed by university study, but instead of acknowledging those skills and utilizing them, we tell those individuals that, unless they have a business degree, they’re worthless. We spend the first fourteen years of our lives being told we can do anything and the next seventy being told we can do anything as long as it isn’t something you have to do with your hands.

The dirty little secret of the United States is that the 1 percent doesn’t support the 99 percent. Those 99 percent of people are the ones supporting the country. The 99 percent of this country are the ones making cars, plumbing houses and flying our airplanes. The 1 percent may contribute thoughts and words, but when was the last time a thought kept you warm at night, drove you to school or kept you from being hungry? The dirty little secret of the United States is that while the 1 percent has the majority of the wealth, they only contribute 1 percent of what we actually use on any given day.

If we are honest with ourselves, we’ve known for a long time that no country can afford to send the majority of its population through what we deem as higher education and its not just because of student debt. No country can afford to send the majority of its population through higher education because those of us going through that system are contributing very little that the world can actually use on a day-to-day basis.

Imagine if 65 percent of the world was architects and only 35 percent were left to construct the buildings they had designed. It is clear none of us would argue that is a world that can work efficiently, or at all. Yet, that is what we as a nation are pushing for. We are pushing for 65 percent of the population to contribute little more than ideas while 35 percent of the population is left with the job of making them all happen. If throughout history only 35 percent of the United States population had been in the business of producing goods instead of ideas, the United States would not exist in nearly the capacity we do today. Why is it that because these days we make our exports out of silicon instead of steel we think that ratio has changed?

A country cannot survive if it does not produce things to be sold; that is an economic fact. So, instead of saddling every student in this country with $26k in debt by the time we’re 22, instead of saddling my home state with $600 million a year in debt so no one has to acknowledge fun slogans on posters don’t always work in the real world, lets face facts. Lets acknowledge that if we weren’t forcing 65 percent of the population through an educational tube built to allow 35, that 35 percent wouldn’t be paying the fortune they are for an education simply through the laws of supply and demand.

It seems like an easy solution to look at the mounting student debt crisis and say lets find some way to help them pay for it because it is always easier to avoid harsh truths. But if the solution were easy, it would have been found long ago. Passing student debt on to other people will never be the answer to this problem; red ink is red ink, regardless of where it is in the checkbook. Until we stop telling ourselves that the only way to be valuable, and valued, is by getting a four-year education, the price of university—and the country's debt—will never go down.

All we have to do is look to one of the smartest men who ever lived: let's remember that if we would stop telling people their worth is determined by their ability to climb trees and started appreciating their ability to swim upstream, both our economy and our population would be in a far healthier place.