The Hidden Costs Of Raising The Wage

Whether you are buying a house, a pair of shoes or dinner out at your favorite restaurant, the sticker price is never the price you pay. The same is true for businesses calculating how much a minimum wage hike might actually cost. Beyond the obvious increase in payrolls for workers, whose salaries would rise from around $9 an hour to over than $13, are a host of hidden costs.

Anyone who’s received a paycheck probably noticed the roughly 8 percent that’s taken out for Federal Insurance Contribution Act (FICA) taxes. This includes a 6.2 percent deduction for Social Security taxes and a 1.45 percent deduction for Medicare taxes. What some people may not realize is that employers are required to match the amount deducted from each employee's paycheck for these taxes; hence, the employer contribution increases when a worker’s wage increases.

To keep things simple, consider the total cost for an employer whose employees currently earn $9 per hour minimum wage and work 30 hours a week (or 120 hours a month). If Los Angeles accepts Mayor Garcetti's proposed wage increases, starting in January, an employee would earn about $150 more each month; yet this change would cost the employer roughly $167 more per month—a little more than $200 each year in FICA taxes alone. Similarly, by 2017 that same employee would earn approximately $510 more each month, but cost the employer $550 per month. This amounts to another $500 each year that the employer must pay in taxes on top of the $6,100 more it would pay in wages.

SEE ALSO: The Low-Wage Worker Who Doesn't Want A Raise

Consequently, a 13.9 percent wage increase for employees translates to an even larger increase for employers.

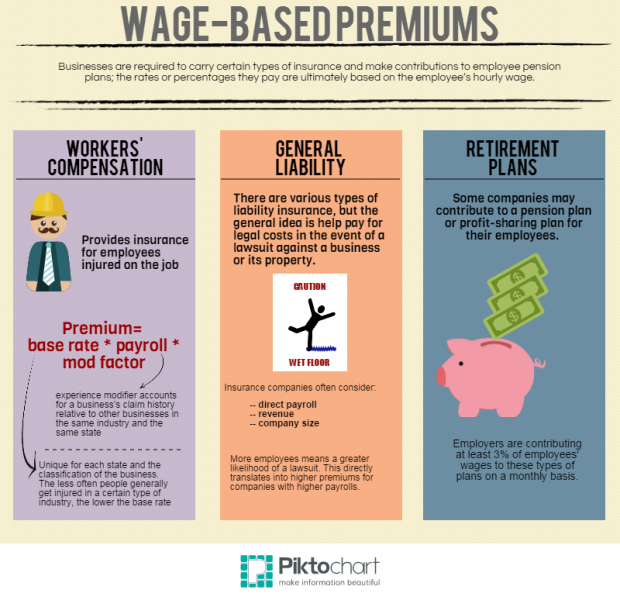

An extra $6,600 a year might seem insignificant compared with some businesses' total revenues, but the full effect of this increased cost depends largely on a business’s size. Does a company employ 10 people, or 100? The annual difference in an employee’s cost will add up quickly. Thus, a wage increase of $4.25 an hour would actually cost employers paying minimum wage about $4.60 more an hour—and this does not even factor in other expenses that increase in conjunction with wages. At a minimum, employers must also account for increased premiums for general liability insurance and workers’ compensation insurance.

Multiple costs will rise in conjunction with the minimum wage. City legislators must keep this in mind while trying to strike the right balance that will ensure between better wages for workers without undermining thebottom line for businesses.

This story is part of a minimum wage series produced by USC Annenberg students.

Contact Contributor Alexandra Farinacci here.