Student Loan Interest Rates Set To Increase

This ain’t your grandparent’s economy, but you already knew that.

Nursing the economy to full health from its 2008 downturn is still a pointed focus of the Federal Reserve. The Fed, a body whose central purpose is to maximize employment and control inflation, will make decisions in the coming months that will have a lasting effect on students and recent grads.

As employment numbers continue to rise and the working class of America slowly shifts from bending down on dirtied knees to standing on two shaky legs, Richard Fisher believes that our “hyper-accommodating economy” needs to be scaled back, stat.

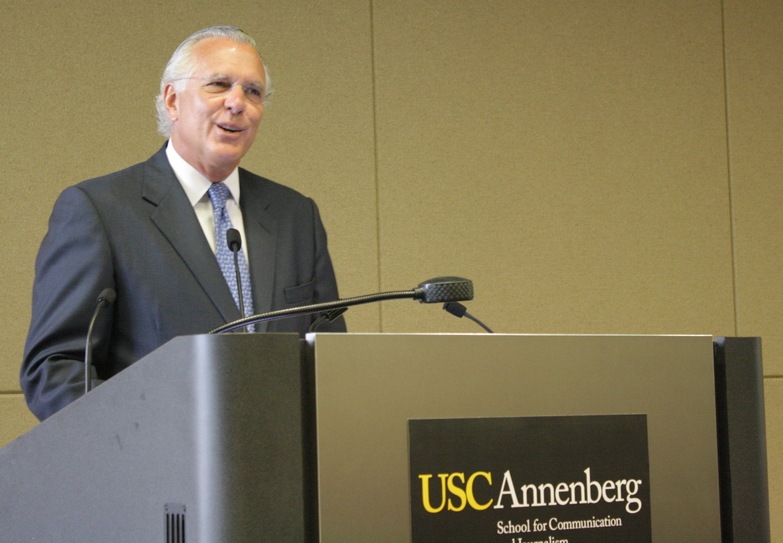

Fisher, president of the Federal Reserve Bank of Dallas stated in a prepared speech Wednesday at USC Annenberg that U.S. employment and inflation are “surpassing goals that were initially speculated” by the Feds.

As a result, the central bank is at risk of injuring the economy or “being viewed as politically pliant” unless it acts quickly.

For Fisher, acting quickly means “slowly letting the steam out of the market balloon” and raising interest rates in order to normalize them. “We must do it slowly. We must taper it,” said Fisher. “There is no room for complacency.”

READ MORE: Student Loan Debt Has Surpassed $1 Trillion

The complex financial lingo and projected consequences of the recovering economy is often convoluted and confusing to those not well versed in the arena; so what does this mean for students in America?

The real question for millions of students boils down to this: How do rising interests rates effect current college students and recent grads who are just beginning to navigate the job market and put roots down?

“The Fed intends to slow down the economy by making borrowing harder for individuals,” said Chris Janssen, a senior financial analyst in Financial Planning and Analysis at Cardinal Health.

“For students, it will be more expensive when interest rates on student loans increase,” Janssen continued. “The goal of the Fed is always to maintain a ‘healthy’ economy. If they feel like the economy is heating up, raising interest rates is an option to slow things down and control how much money is available for businesses, home buyers, and consumers.”

This method, known as monetarism, is a school of economic thought that works by allowing the government to control the amount of money in circulation.

READ MORE: GOP Leader Accused Of Asking Students To “Dream A Little Smaller”

Unfortunately for students, student loans are widely considered to be black holes that have now totaled well over $1 trillion nationally. As the economy continues to recover, students will see increased interest rates on their loans as an immediate effect of the Fed’s plans.

As recent graduates move begin to consider buying houses, vehicles and other big-ticket items, money will be harder to borrow, which could continue to drive a wedge between socioeconomic groups. There will be those who secure well-paying jobs and can afford the hikes; then, there will be those who cannot find those jobs.

Fisher argues that the real problem is that Congress and President Obama are not synthesizing incentives for job creation. Without this, Fisher argues, graduates won’t have the resources and jobs that they need in order to burrow their way out of the student loan rabbit hole.

“Congress and the President are the fiscal authorities who make taxes, and decide where your money is going to go,” Fisher said in a press conference following his address.

“We put the fuel in the car,” said Fisher. "But we don’t put our foot on the accelerator. We try to create monetary policies, but Congress and the President are not creating incentives. As students, remember: you have the power because you vote.”

Reach contributor Diana Crandall here. Follow her on Twitter here.