Congressional Research Service Disproves Trickle-Down Economics

Its findings, although commonly supported in academia, should have a substantial impact on public policy for two main reasons. First, the CRS is a non-partisan research group with a direct line to our congressmen. Therefore, its findings should be acknowledged by our policymakers. Second, its conclusions refute an old economic theory that has been the backbone of the Republican Party for 30 years.

The Republican Party has been obsessed with the theory of trickle-down economics. In short, this theory states that if the income of those at the top increases, then the growth will trickle down to those at the bottom. Recently, this theory has been renamed. The Right’s new rhetoric refers to the wealthiest among us not as “the rich” but as the “job creators.” Yes, the Right is still very much in love with trickle-down economics. However, the CRS data suggests that it is time for the two to break up.

For years, the public has been spoon-fed the idea that the government can, under no circumstances, raise taxes on high income earners, because that would lead to lower economic growth. Fortunately, enough time has passed to actually put that theory to the test. The CRS tests the relationship between top tax rates and four other economic measurements: saving and investment, productivity growth, per capita GDP growth and income disparity. The results disappointed many Republicans in Congress.

Looking at data over a period of 65 years, the CRS concluded that neither saving and investment, productivity growth nor per capita GDP growth shared any strong statistical relationship with top tax rates. That means that lowering top tax rates does not improve economic growth. In fact, the trend lines, although coincidental, showed that higher tax rates are associated with higher per capita GDP growth, saving and productivity. In other words, if one wanted to employ the trends associated with top tax rates and economic growth, he or she would have to conclude that high top tax rates are ideal.

Not all the relationships are coincidental, however. The CRS concluded that there is a strong statistical relationship between income disparity and top tax rates. Over the last 65 years, the reduction in top tax rates has gone hand in hand with the rise in income disparity. The rise of trickle-down economics in the 1970s is the same point in time at which the incomes shares of high income earners began to skyrocket. According to historical trends, the only outcome we can expect from lowering top tax rates is a further widening of the gap between the rich and everyone else.

I would hope that this report might convince many Republicans in congress to consider at least slightly raising top tax rates. However, this report failed to address two other myths that seem to be infecting the Right's water supply.

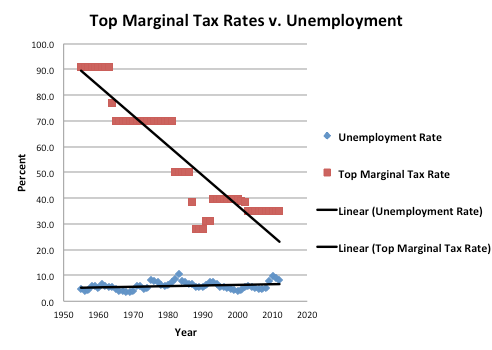

I have repeatedly heard that raising taxes on the “job creators” will cause them to stop creating jobs (a rather odd consequence given their new title). If this assumption is true, then there should be a positive relationship between top tax rates and the unemployment rate (higher top tax rates should be associated with higher unemployment). My graph below, using data from the Bureau of Labor Statistics and the Tax Foundation, reveals yet another disappointment for the “job creator” theory.

Reducing the top tax rate for high income earners is in no way related to lower unemployment. It would therefore seem that this threat of “job creators” forgoing job creation is an empty one.

Lastly, there is the question of fairness. A common counterargument to raising tax rates on high income earners is that they already pay a disproportionately large share of the taxes. Some have gone as far as to say that they should be paying an even lower rate in order to correct this “unfair burden” they carry. However, this argument is misleading and relies on the assumption that the tax rates are the only important indicator of fairness. To understand the flaws of this argument, consider the following scenario:

Suppose there is a country with only 100 people. In this country, 10 people earn $10 million a year and the other 90 people earn an average $200,000 a year. Now, suppose the tax rate was flat (all income groups paid the same rate) at 25 percent. Together, the top 10 earners would pay $25 million dollars in taxes while the other 90 would pay $4.5 million. Therefore, the top earners would be paying nearly 85 percent of the federal income taxes.

I doubt any reasonable person would argue that the 10 high income earners are being treated unfairly. After all, everyone is paying the same tax rate. So why do the 10 high income earners pay a whopping 85 percent of the taxes? The answer is obvious: they earn far more money. This scenario shows that higher income earners can pay a larger share of the federal income tax by either:

A) Earning far more income than lower earners, or

B) Being taxed at a much higher rate.

In the case of the United States, where the top one percent holds nearly 20 percent of total income and pays a tax rate of only 35 percent, I would bubble in option A on any fairness test.

Trickle-down economics has been put to the test and has wholeheartedly failed. As Nobel Prize winning economist Joseph Stiglitz writes in his book, "Globalization and Its Discontents," “trickle-down economics was never just more than a belief, an article of faith.” This unfounded belief has allowed Republicans to repeatedly refuse an extension of the Bush tax cuts for middle and low income Americans, until the wealthiest get theirs as well. It has allowed Republicans to walk into deficit reduction meetings and refuse to even consider raising revenues. It has prevented the President from financing another much-needed stimulus package.

The American people have been misled long enough, to their detriment. Congress has finally received the message: raising top tax rates will not slow the economy. The question that remains is: will they listen?

Reach Contributor Alex Blow here.