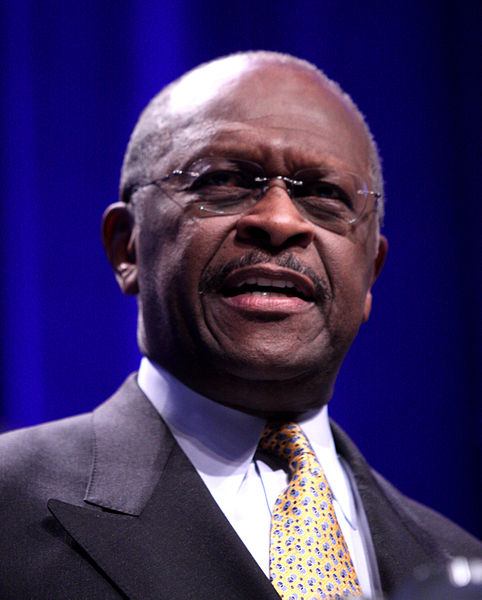

Cain's 9-9-9 Plan: A Step In The Right Direction

Cain proposes to scrap the tax code, which he referred to as the 21st century version of slavery, and replace it with a 9% corporate flat tax, 9% personal flat tax, and a 9% national sales tax. To generate enough revenue the government would actually have to levy a 9.1% tax across the board; 9-9-9 just sounds catchier to voters.

Cain’s adviser Rich Lowrie is responsible for the plan. He is an investment adviser at Wells Fargo and earned a degree in accounting from Case Wester Reserve University. He’s not an economist, nor does he claim to be. Honestly, it seems more likely that he ripped off this tax scheme from the Sims than coming up with it on his own.

Bruce Bartlett, an analyst who has held senior policy roles in the Regan and Bush administrations, was extremely critical of the plan in a New York Times post last week, calling it “exceptionally ill conceived.” He explains the three phases the plan actually calls for, makes the Left’s argument that the tax burden will fall on the poor and asserts the plan isn’t as simple as Cain sells it to be.

Steve Moore, senior economics writer at the Wall Street Journal, reported on Fox that new studies about this plan done by independent analyses found that it would raise the necessary revenue just as the current 35% corporate tax structure and 40% income tax rate.

Admittedly, the details of the plan are vague. When asked specific questions about international revenue and foreign products sold in U.S. markets, Cain didn’t have answers about how those would be taxed, simply saying, “I have no idea.”

Even though the plan is unconventional for the U.S. tax system, Cain’s and his advisers should work out the details. Independent analysts have not only found the plan could work, but also suggested it can substantially benefit the economy. Reducing corporate taxes by 26% would motivate businesses to hire and in theory help the economy grow. Some economists even argue this is a first step to stop job outsourcing. Even if the details aren’t perfect, Cain’s plan is a step in the right direction.

The problem is that a perfect 9-9-9 tax plan would never garner enough support. First, regardless of political persuasion, no Congressman would support such a transparent tax structure. As a Forbes article points out, the convoluted tax structure gives Congress too much power to incentivize, punish and generally manipulate the system. As it currently stands, the U.S. tax code is about 73,000 pages, and that is intentional.

Second, Cain does not have support from either political party. Republicans oppose the plan because they feel a national sales tax would be too easy to increase. What makes no sense about this objection is that Cain’s tax platform would make the tax code more transparent. Ideally this means the corporate loopholes conservative-minded, middle class voters complain about would disappear. Tax hikes would be obvious, not slyly added in among 500 other new laws, and best of all the tax code would be easy to enforce. None of the other GOP candidates have proposed anything as drastic or as popular among likely voters. Mitt Romney, tied as the leading GOP candidate with Cain in a recent NBC/WSJ poll, proposes to lower the corporate tax rate to 25%. While this is an improvement, it’s certainly not a large enough tax break to fix fundamental problems with the system or incite economic growth. Bartlett argues that Cain’s overhaul of the system will place a burden on the poor without guaranteeing economic growth. There is now way to guarantee economic improvement or even that tax breaks will cause a change; however, it seems logical that a 26% corporate tax break will have more of an impact than a 10% cut. Republicans need to realize this.

Not surprisingly, Cain’s plan will not win support from Democratic officials. Liberal-minded folk argue the 9-9-9 plan will shift the tax burden to the lower and middle classes and allow wealthier people to pay less. While there is absolutely no denying this will happen, it does not necessarily follow that that is a bad thing. People paying little to no federal income tax would have to pay 9% in income tax, not to mention there would be a 9% national sales tax on groceries. This would impact the lower classes more than any other economic class. Bartlett says the problem here is that, “the 47 percent of tax filers who pay no federal income taxes will pay 9 percent on their total income.”

The problem here is not that low income people will have to pay less than 10% in income taxes, it’s that 47% of Americans pay no federal income taxes at all. Cain argues that the drastically lower corporate tax rate would stimulate business growth, creating jobs, boosting the economy and compensating for the extra taxes the lower income workers would have to pay. All of this is of course speculation.

Theoretically it makes sense but in practice, it’s impossible to say if it could actually work. The bottom line though is this: no one will fix the economy by catering to the struggling strata of people. This does not mean policy makers should ignore the needs of lower income individuals, rather that the solution to our struggling economy lies in a radically different solution, like the 9-9-9 plan, rather than just throwing money around. As a college student I’m not thrilled at the prospect of paying an extra 9% tax on food, but if it’s a step in making it easier for me to get a job out of college then I’ll seriously consider it.

Reach reporter Alexandra Farinacci here

Best way to find more great content from Neon Tommy?

Or join our email list below to enjoy Neon Tommy News Alerts.