Debt Management 101

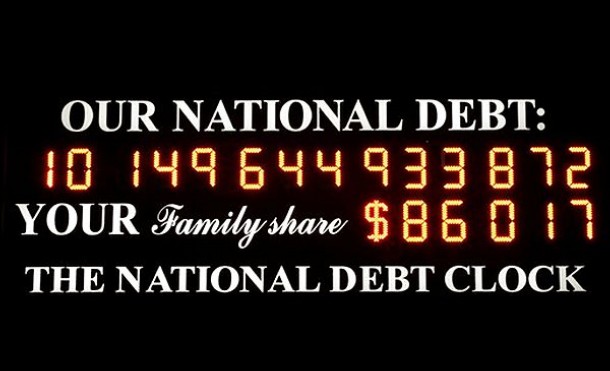

Last October, Douglas Durst, son of national debt clock creator Seymour Durst, had to remove the Times Square clock's dollar sign to make room for another number: the extra one in 10 trillion.

A month later, that figure's pushing $10.6 trillion, an increase of $600 billion.

Factor in the recent bailout bill, and the debt will easily swell past $11 trillion before the end of the year. Good thing Durst is thinking ahead this time--next year he'll unveil a clock that has enough digits to account for a quadrillion dollars, or $1,000,000,000,000,000.

And you thought balancing your own accounts was tricky.

You'd think it'd be America's taxpayers--all 138 million of them who filed in 2007--who would be on the hook for the $10.6 trillion.

Not so, says University of Southern California macroeconomist Selahattin Imrohoroglu. Only about $6.4 trillion of that debt is public debt, he says; the rest is owned by foreign governments. That means if the country suddenly had to pay back the public debt, each taxpayer would owe around $46,376.

So I wondered, what if I were the U.S.? What would my finances look like on a national scale? And what if the U.S. were me? How would our debts and incomes stack up against one another?

Right now, I'm in the hole for about $50,000--all of it school loans. It's a daunting debt for a hopeful journalist. But in percentage terms, my debt is only about 8 percent higher than that of my country, which is pretty sobering.

I do manage to make some money here and there doing freelance work in between school assignments, but none of it goes toward paying back that debt--it only keeps me from going about $7,000 deeper into debt each year.

But as Imrohoroglu points out, "debt is a meaningless number." What really matters, he says, is the ratio of a country's debt to gross domestic product, or GDP. That's the amount of debt divided by the value of all of a country's goods and services a year--sort of an annual income, if you will.

It doesn't matter if a country's debt is large, so long as its GDP is larger. That is, so long as it earns more than it spends. U.S. public debt is about 60 percent of its $13.8 trillion GDP , which isn't great.

But it isn't all that bad.

To figure out my personal GDP, Imrohoroglu explains, I'd have to calculate my average yearly income for the rest of my life. Considering the job market is pretty weak right now, coupled with the fact I'm a journalist, $40,000 a year on average for the rest of my life is a realistic and maybe somewhat conservative estimate. That means my $50,000 debt to $40,000 GDP ratio is around 125 percent.

My debt-to-GDP ratio is about twice that of the U.S. But I don't have to look far to find a country with my same ratio. "You're Jamaica , mon!" exclaims Imrohoroglu, because my debt-to-GDP ratio is pretty much on par with the Caribbean nation's. Not to worry, three countries outpace my somewhat high ratio--Japan at 170 percent, Lebanon at 186 percent and Zimbabwe at a whopping 218 percent.

So, looks like my debt ratio isn't as favorable as America's, even though it still fares pretty well against a handful of countries. But as a poor graduate student who rides a bus to school every day, how do my expenses stack up against those of the wealthiest and most influential superpower the world has ever known?

I spend about $32,000 a year on school and living expenses, $7,000 of which comes from freelance work.

The U.S. spent about $2.73 trillion in 2007. A quarter of that, according to the government , went to health and human services, 20 percent went to defense, 2.5 percent was used for education, 2.3 percent went to transportation and 1.2 percent went to housing and development. The rest goes to services and programs that don't translate well into my life. Like agriculture.

Considering my tuition includes health insurance--a cost I'd have to shoulder on my own, at a much higher rate, if not for the university--and that I've avoided the doctor since I started school, the only money I'm spending on health goes to food. That's about $10 per day, $3,650 per year, or just above 11 percent of my budget. And in all honesty, it might be much less; I've earned an honorary degree in finding free food on campus.

When I graduate, I'll have spent about $40,000 over two years on education. That's about 62 percent of my overall expenses, which means that I'd have spent about $1.8 trillion on education if I were the U.S., or about 26 times more than the government spent on schooling in 2007. If the government were shrunk down to my size, it would only be spending about $1,500 a year on education--about a unit and a half in my master's program, which requires I take 40 of them to graduate. Assuming tuition rates stayed constant, which they never do, the U.S. at its current spending pace would take about 27 semesters to complete a degree that I'll finish in 4.

Factor in transportation at $32 a month for a bus and rail pass and that's 1.2 percent for transportation. Housing, at $600 a month, makes up 22.5 percent of my spending each year. All together, these expenses make up about 97.6 percent.

Of course, I have to set aside at least 1 percent, or $320, of my budget for emergency expenses, like 12-packs of Miller High Life. That means if I were the U.S., I'd be spending about $27.3 billion on booze--enough to buy every person in the U.S. about 10 12-packs of the Champagne of Beers.

But what about defense? It makes up about 20 percent of the U.S. budget, which, according to some analysts, is an extremely conservative estimate. But it's barely a factor in my own budget, unless you count the 3 protein bars I buy each week at $2 a pop at my school's free gym. These chalky, tasteless slabs of whey go toward defense because they help rebuild muscle after a workout--you know, for my guns. Throw in about $100 per year in gym locker fees and my yearly defense budget is around $412, or 1.4 percent of my overall budget.

But if I were the U.S., I'd be spending around $5,000 dollars at my school's gym--hardly worth the cost considering most of its equipment is broken. That cost means I'd either be eating 47 protein bars a week, or that I'd seriously have to renegotiate my locker-fee contract.

Revealing, to say the least.

But now that we're in a recession, the U.S. might want to consider knocking off a percent from its bloated defense budget and using it for all those High Life 12-packs. Not that it would solve any problems, but 120 beers sure would help take the sting out of its citizens' dismal financial situations.

Now there's some economic news worth a toast.